The Bank of India has one of the largest reserves of gold in the world and this speaks volume for the love Indians have for this precious metal. Gold is undoubtedly a symbol of wealth and status. Not only that, the likelihood of the economic value of gold falling to nil or it suffering a default is slim to none. When one includes gold in their investment portfolio it helps neutralise the other high-risk investment instruments such as stocks and mutual funds and hedges the effects of inflation.

Investing in precious metals comes with its own challenges. When one purchases physical gold in the form of coins or bars, the issue of storage, maintenance and safety arise. One will also have to incur storage as well as making and wasting charges when it comes to buying gold jewelry. If you are looking to invest in Gold ETFs, a superior understanding of the market along with a trading and demat account is necessary. Digital Gold is the answer that we seek, that will overcome the prevailing obstacles and allow an investor to buy and sell this precious metal as per their convenience.

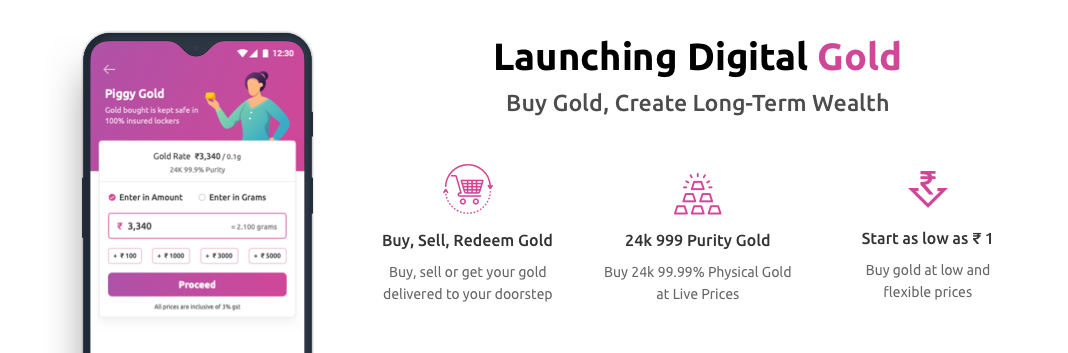

What is Digital Gold? It is a global currency system, free from exchange rate manipulations and variations. It allows the investor to easily trade throughout the world without actually touching physical gold. The best part is that one can purchase or sell it in fractions. Gone are the days when one had to wait to save sufficient money to make the desired purchase. The advent of digital gold now allows investors to make gold purchases in denominations as low as INR 10.

Let us take a look at some of the key differences between digital gold and regular gold.

1. Investment Size

For an individual to invest in physical gold they will need to purchase at least one gram of gold whose price fluctuates every day. Whereas, digital gold can be bought and sold in denominations as less as INR 10. This makes it highly affordable and convenient as one can make investments in fractions of grams. Its smaller investment size encourages people, even those with limited income, to invest.

2. Storage

There are safety concerns when it comes to the storage of physical gold. Keeping gold at home is quite risky due to the looming fear of it being stolen. To safeguard your investment, you will need to keep it in a bank locker and incur long term storage costs like registration charges, annual fees, and service fees which are expensive.

Digital gold frees you from storage problems and expensive long term costs. Those who trade in digital gold offer facilities to their investors to hold their accumulated gold in secure and safe vaults at a nil or nominal charge.

3. Liquidity

Gold in comparison to other assets is considered highly liquid. Yet, physical gold still faces certain liquidity issues. For example, to liquidate this physical yellow metal and receive the complete resale value, selling it to the dealer from whom you bought it is mandatory. The original purchase bill is also a requirement in order to get the entire resale value.

Digital gold can be bought and sold effortlessly, anywhere and at any time as per your will. This cuts out the need for you to visit a dealer or safely keep a purchase bill for many years in order to get the complete resale value of your investment in the future.

4. What you pay for

When one purchases gold jewelry, they not only pay for the cost of gold but also for the making charges and other applicable taxes. Jewelers can charge anywhere between 7 to 25 percent depending on the design. If the chosen piece of jewelry includes precious stones or gems, then the cost increases proportionately. Keep in mind that at the time of liquidation one will not get back the various ancillary costs.

When you deal in digital gold, you deal only in pure gold. The amount invested by you goes entirely into gold and gold only.

5. Trading

If you wish to trade in physical gold, you will need to schedule a meeting with your bank or jeweler which is both time-consuming and inconvenient.

Trading in digital gold is convenient because you can buy and sell it online with a few simple clicks. After a sale, the money gets directly transferred to your registered wallet or bank account within a few days.

Gold has been in use for over 3000 years and has stood the test of time of being just as valuable as it was back in the days to today. The prices tend to fluctuate but its value is truly priceless. Gold cannot be manufactured, it is also scare and indestructible. In the future, more and more investors will need to start investing in this precious metal through digital gold.

Make small investments for bigger returns.

Make small investments for bigger returns.