NAV: Rs. 6,312 crore (As on 28th February 2019)

Exit Load: 1% for redemption within 365 days

P/E Ratio: 15.62

Expense Ratio: 2.12%

Turnover: 15%

The HDFC Small Cap Fund is an actively managed, open-ended Equity Mutual Fund that carries a small-cap bias. The fund seeks to provide its investors with high long-term capital appreciation through systematic investments in equity and equity-related instruments of small-cap companies that have the potential to become tomorrow’s market leaders. This fund operates in the relatively volatile, small-cap and mid-cap market segments of the market and, therefore, investors in this fund should expect frequent fluctuations in returns over the short term.

Suitable Investors

The HDFC Small Cap Fund takes an exposure of approximately 90% towards the small-cap and mid-cap segments of the market. These segments of the market are considered highly volatile as they consist of companies that are in their infantile stages or going through expansions. Investors in the HDFC Small Cap Fund should have a high tolerance for risk and long investment cycles, as this fund performs well in long investment cycles of at least 3 years. As this fund is exposed to a large amount of market risk, it is recommended to seasoned investors.

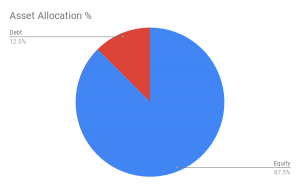

Asset Allocation

The HDFC Small Cap Fund is an Equity Mutual Fund that carries a small-cap bias. The fund primarily looks for investment opportunities within the small-cap segment but does not restrict itself to this segment. Under certain market and macro-economic conditions, this bias can be shifted towards the mid-cap or large-cap segments of the market. The fund also invests approximately 10% – 15% in debt and other stable money market instruments to counteract the effect of market volatility on the fund and to provide it with good liquidity. As this is an actively managed fund the fund manager has the ability to change the composition of investments based on the prevailing market conditions. The asset allocation of the fund according to its mandate has been provided in the table below.

| Instrument | Minimum – Maximum | Risk Profile |

| Equity | 80% – 100% | High |

| Debt | 0 – 20% | Low – Medium |

The present asset allocation of the fund has been provided in the chart below.

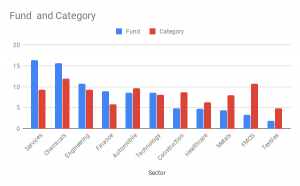

Portfolio

The HDFC Small Cap Fund is a highly diversified Equity Mutual Fund that invests across market sectors in the small-cap and mid-cap segments of the market. The fund distributes 88% of its assets across 70 stocks in companies operating in the Services, Chemical, Engineering, Finance, and other crucial economic sectors. The fund presently takes a 59% exposure to small-cap stock, which is slightly lower than the benchmark and category average. The fund takes a 37% exposure to mid-cap stocks, which is higher than its benchmark and category average. The HDFC Small Cap Fund also invests marginally in debt and other money market instruments to provide investors with good liquidity and provide the fund with a level of stability during volatile market cycles. The present sectoral allocation of the fund has been provided in the chart below.

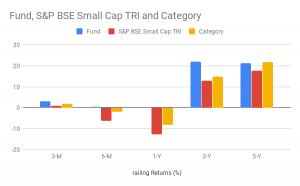

Performance

The HDFC Small Cap Fund was launched in April 2003 and has outperformed its benchmark and category on a few occasions. The fund saw its best performance between March 2009 and March 2010, when the markets were performing well. The fund carries a high Alpha of 9.81 when compared to the category average of 2.30 and a Beta of 0.73, which is marginally lower than the category average of 0.76. This demonstrates the fund’s ability to generate higher-than-expected returns while providing a decent level of stability. The fund performs best in investment cycles of 3 years. The trailing returns of the fund against its category and benchmark have been provided in the chart below.

Investment Objective

The HDFC Small Cap Fund seeks to provide its investors with long-term capital appreciation through systematic investments in predominantly small-cap and mid-cap stocks. The fund is actively managed and can, therefore, change its investment composition to suit prevailing market conditions. The fund cannot guarantee that it will achieve its objective.

Investment Philosophy

The Fund follows a growth style of investment, concentrating more on the future potential of stock to perform well rather than its current market value. The fund tries to invest in undervalued stocks and seeks to generate capital growth through price changes. The HDFC Small Cap Fund considers multiple factors while investing in a stock, the performance of the company, the efficiency of capital allocation, management efficiencies, sector performance and other qualitative and quantitative parameters. The fund also invests marginally in high-quality debt and other money market instruments to provide a regular income to investors as well as good liquidity.

Make small investments for bigger returns.

Make small investments for bigger returns.