The L&T Midcap Fund was launch on January 1st, 2013 by the L&T Mutual Fund House. The L&T Midcap Fund is an open-ended, actively managed equity mutual fund that takes a large exposure to mid-cap company stocks. The fund seeks to provide its investors with long-term capital appreciation through an actively managed portfolio of mid-cap stocks. The L&T Midcap Fund tries to find companies today that have the potential to become future market leaders and for this purpose, it invests in companies that demonstrate high potential for growth and sustainable business practices. The fund seeks to invest in companies that have efficient capital allocation mechanisms and good managerial systems.

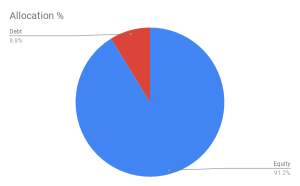

Asset Allocation

The L&T Midcap Fund is an equity fund and therefore the fund takes majority exposure of equity. The fund also invests nominally in debt to provide investors with good liquidity and a level of stability during turbulent market cycles. The asset allocation of the fund according to its mandate has been provided below.

| Instruments | Minimum Allocation | Maximum Allocation | Risk Profile |

| Equity and Equity Related Instruments | 80% | 100% | High |

| Debt and Other Money Market Instruments | 0 | 20% | Moderate |

Investments in Securitized debt cannot exceed 20% of the total assets of the fund

Investments in Equity Derivatives cannot 50% of the total assets of the fund

The scheme invests 65% of the total assets in mid-cap stocks

Portfolio

The L&T Midcap Fund is an equity mutual fund that follows a growth style of investment in predominantly mid-cap equity stocks. The fund currently distributes its investments across 79 stocks of mid-cap, small-cap and large-cap funds. The fund takes majority exposure to mid-cap stocks but also invests nominally in small-cap to bolster its returns and large-cap to provide long-term capital appreciation. The fund also makes a small investment of approximately 9% in debt to maintain liquidity in case of heavy redemptions during a particular period. The L&T Midcap Fund invests heavily in the Finance, Construction, Engineering, and Healthcare sectors of the Indian economy. The current asset allocation of the fund has been provided below.

| Instrument | Allocation % |

| Equity | 91.22 |

| Debt | 8.78 |

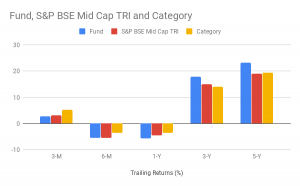

Performance

The L&T Midcap Fund has been a top performer in its category for a while now. The fund has almost consistently outperformed its category and benchmark. The fund is able to mitigate losses during bearish periods and is able to generate good returns during bullish periods. The L&T Midcap Fund saw its best performance between March 2009 and March 2010. The fund also carries an Alpha of 2.14, which is considerably higher than the category average of -2.03 and a Beta of 0.86 which is the same as its category average. This demonstrates this fund’s ability to generate higher-than-expected returns while not taking on too much risk. The trailing returns of the fund against its benchmark and category have been provided in the chart below.

Investment Philosophy

The L&T Midcap Fund invests primarily in mid-cap equity shares and equity related instruments according to its mandate. The fund currently carries 79 stocks in its portfolio with the top 10 stocks contributing approximately 23% of the total stocks. The fund has a slightly high cash allocation of approximately 11%. The sector diversification is also good, the top three sectors the fund invests in contribute to approximately 45% of the total portfolio. The fund is well-diversified and, therefore, can mitigate concentration risks arising from concentrating exposure towards specific industries. The fund employs a bottom-top analysis while stock picking, concentrating more on the performance of individual stocks rather than the industry as a whole. The fund carries a low turnover of 28%, demonstrating the Fund Managers confidence in the stocks and their conservative investment strategy.

Make small investments for bigger returns.

Make small investments for bigger returns.