Advance Tax, as the name suggests allows taxpayers to pay their income taxes before the end of the financial year. Individuals with a tax liability greater that Rs. 10,000 can avail the Advance Tax payment facility. The Advance Tax facility was launched by the Income Tax Department to reduce the burden on the taxpayer at the end of the financial year, where the taxpayer needs to pay their entire annual salary in one lump sum.

The Advance Tax facility allows a taxpayer to pay their taxes in 4 installments through the financial year, the schedule of these Advance Tax payments is provided by the Income Tax Department.

Advance Tax is usually paid by individuals who have sources of income other than their salary, like interest on investments, capital gains, rent from property etc, as these sources of income are not accounted for by your employer, it would advisable to pay Advance Tax on them.

Advance Tax can be availed by;

Individuals

Corporations

Freelancers

Professionals

The Advance Tax payment schedule for the Financial Year 2018-19 is provided below.

| Advance Tax Installment Date | Amount Payable |

| 15th June | 15% of Tax Payable |

| 15th September | 45% of Tax Payable |

| 15th December | 75% of Tax Payable |

| 15th March | 100% of Tax Payable |

Mistakes to avoid while paying tax

Select the correct Assessment Year: While paying your taxes make sure you select the Assessment Year (AY) correctly. The Assessment Year is the year immediately following the Financial Year (FY). For the FY 2018-19, the AY is 2019-20.

Select the correct tax payment: A lot of people get confused when it comes to selecting the type of tax to be paid. At the time of tax payment, there are a number of option buttons with various tax codes that appear on the screen, if you select the wrong code your tax payments will not reflect in your Form 26AS.

For Advance Tax payment select the next financial year, as this will be the assessment year, and the code ‘100 – Advance Tax’. Payment of Advance Tax is made through Challan 280.

Estimated Total Income Calculation

Advance Tax is calculated by estimating the current year’s income and then applying the applicable tax slabs. The calculation to get the estimated total income is

| Income from Under the 5 Heads of Income | XXX | |

| Less | Bought Forward Losses and Allowances | XXX |

| = | Gross Total income | XXX |

| Less | VI – A Deductions | XXX |

| = | Estimated Total income | XXX |

Calculation of Income Tax on Estimated Total Income

| Estimated Total Income | XXX | |

| (Add) | Surcharge if any on Estimated Total income | XXX |

| = | Total Tax Payable | XXX |

| (Less) | Relief Under Section 89 | XXX |

| = | Tax Liability | XXX |

| (Add) | 2% Education Cess | XXX |

| (Add) | 1% SHEC (Secondary and Higher Education Cess) | XXX |

| = | Total Tax Liability | XXX |

| (Less) | Tax Relief Under Section 90, 90A, 91 | XXX |

| (Less) | MAT Credit Under Section 115JAA | XXX |

| (Less) | TDS as shown in Form 16/Form 16A and reflected in Form 26AS | XXX |

| = | Advance Tax Liability | XXX |

Here are the steps involved in making Advance Tax Payments online.

Step 1: Open the Tax Information Network and click on the option ‘Pay Taxes Online’ option

Step 2: On the ‘Pay Taxes Online’ page under the heading ‘Non TDS/TCS’ you will find the CHALLAN NO./ITNS 280 for payment of Income Tax and Corporation Tax. Select this option.

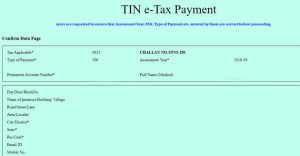

Step 3: You will be redirected to the e-payments page. Here you can select the ‘(0021) Income Tax (Other than Companies)’ option. Fill in the required details like PAN, Address, Full Name.

Step 4: Select the type of tax you would like to pay ‘(100) Advance Tax Payment’ ‘(300) Self-Assessment Tax Payment’. Select the mode of payment, ‘Netbanking’ or ‘Debit Card’. Enter the Captcha code at the bottom. Double-check all the information and click on ‘Proceed’.

Step 5: You will be redirected to a page to re-check the provided information. After checking the information provided click the ‘Submit to Bank’ button.

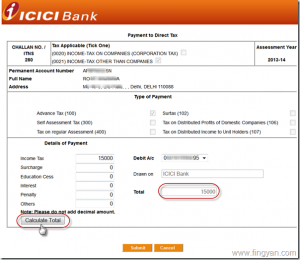

Step 6: You will now be redirected to the bank’s website, where you will be required to login to your Netbanking account or enter your Debit Card details depending on the payment mode selected. You will also need to provide the amount of tax to be paid.

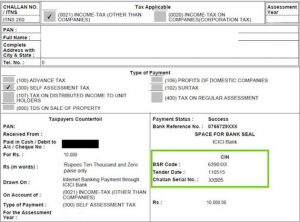

Step 7: Once the payment is completed a receipt will be generated. The receipt will contain details like Amount of Tax paid, Date of Challan, Challan Serial Number, BSR Code etc. While filing your Income Tax Returns (ITR) these details will be required.

Make small investments for bigger returns.

Make small investments for bigger returns.