The Indian Mutual Fund industry comprises of 43 Asset Management Companies that offer over 2,000 Mutual Fund Schemes. The average Assets Under Management (AUM) of the Indian Mutual Fund Industry stands at over Rs. 24,00,000 crore. This industry has seen a growth of approximately 10% annually. Even though the Mutual Fund industry in India has been seeing good growth, there has been a large section of the population unable to participate in it due to the industry being largely Shariah non-compliant.

Of all the schemes being offered by mutual fund houses in India, there are only 2 funds that are certified Shariah compliant, the Tata Ethical Fund and the Taurus Ethical Fund. The Tata Ethical Fund and the Taurus Ethical Fund are actively managed multi-cap schemes.

There are other schemes that are not certified shariah-compliant but can be considered so, one such fund is the Reliance ETF Shariah BeES which is an Exchange Traded Fund that invests in the Nifty 50 Shariah Index. The Reliance Pharma Fund, ICICI Prudential Pharma Healthcare & Diagnostics Fund, SBI Technology Fund, ICICI Prudential Technology Fund, and the Franklin India Technology Fund can be considered shariah-compliant, but have not been certified shariah-compliant. Information about the certified shariah-compliant funds has been provided below.

Certified Shariah Compliant Funds

Tata Ethical Fund

NAV: Rs. 156.23

Expense Ratio: 0.74%

P/E Ratio: 25.47

Minimum SIP: Rs. 500

Minimum Investment: Rs. 5,000

Exit Load: 1% for redemption within 365 days

The Tata Ethical Fund is an open-ended equity fund which invests in a diversified equity portfolio based on principles of Shariah. The investment objective of the scheme is to provide medium to long-term capital gains by investing in Shariah-compliant equity and equity-related instruments of well-researched value and growth-oriented companies.

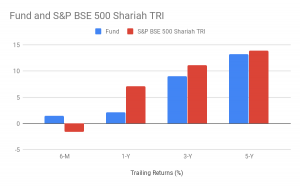

The fund was launched in January 2013 and has performed well among its peers. The fund managed to outperform its category and benchmark in 2014 and 2017, seeing its best performance between February 2014 and February 2015. The trailing returns of the fund against its benchmark has been provided below.

Taurus Ethical Fund

NAV: Rs. 50.58

Expense Ratio: 2.60%

P/E Ratio: 28.66

Minimum SIP: NA

Minimum Investment: Rs. 5,000

Exit Load: 0.5% for redemption within 180 days

Taurus Ethical Fund is an Open Ended Equity Oriented Scheme that will invest in companies which are in compliance with the Shariah norms. The scheme will primarily invest in Equity and Equity related instruments. The fund is Actively Managed and invests in diversified portfolios.

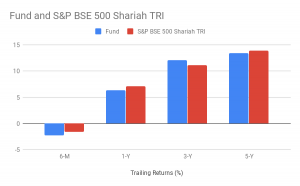

The fund was launched in January 2013 and has outperformed its benchmark on two occasions, in 2014 and 2017. The fund saw its best performance between September 2013 and September 2014. The trailing returns of the fund against its benchmark has been provided below.

Make small investments for bigger returns.

Make small investments for bigger returns.