Gold continues to hold sway across generations in India. The yellow metal is purchased throughout year-be it for auspicious occasions like Akshaya Tritiya, Diwali, Dhanteras, as an apt gifting option in ceremonies like marriages or to strengthen the emotional bonds between close relatives, the closeness of ties being emphasized by the high value associated with gold as a commodity, as a safe asset to include in one’s investment portfolio to hedge against the impact of inflation or simply to be worn as precious jewelry and ornaments. Gold, being symbolic of wealth, is an all-weather, preferred choice for Indians both for investment purposes as well as personal use. The statistics reveal the prevalent craze behind buying gold. In spite of the sky-high prices of gold and alternatives like platinum and diamonds being showcased as a more premium choice, the demand for gold jewelry touched a 4 year high of 125.4 tonnes in the first quarter of 2019, as per the World Gold Council and a Quartz India report.

Are users spoilt for choice?

Physical gold in the form of bars, coins or jewelry has certain drawbacks like the need for secure storage and proper maintenance. Further, in case of purchase of gold jewelry, there is a loss in value by way of making charges and wastage and a markdown in value by way of purity percent upon sale. Online purchase of gold is another attractive option. Gold Sovereign bonds can be subscribed to only at certain periodic intervals. Gold ETFs need a thorough conceptual understanding of market conditions and mandatory opening of a demat-cum-trading account with a brokerage.

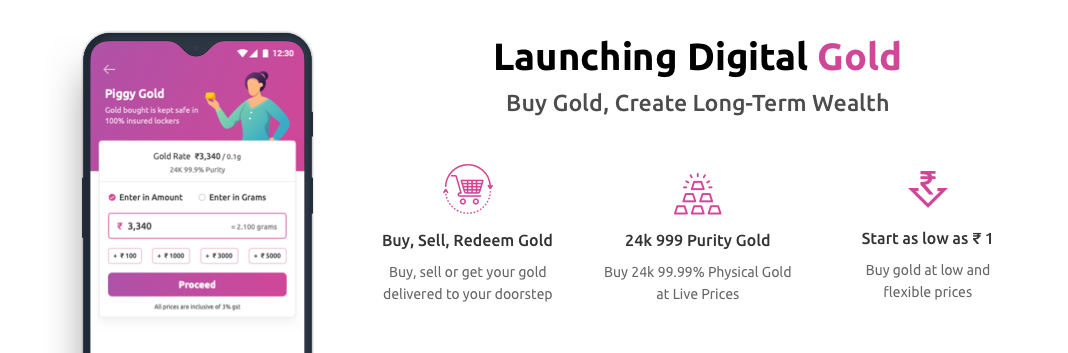

Digital gold helps overcome these shortcomings and is gradually becoming a popular method of buying, selling and investing in gold.

What is Digital Gold?

Digital Gold is a recent option introduced in India, whereby one can invest in and accumulate pure 24K physical gold via the online route in any denomination including fractional quantities. Thus, even with a minuscule monetary investment of Re. 1, one can buy a certain quantity of the precious metal. This convenience of any time and anywhere, secure purchase and sale of the yellow metal is gradually gaining traction amongst the investor community, especially millennials who would prefer to hold gold digitally, over physical hoarding. In India, the option of investing in digital gold is being offered in collaboration with Augmont, MMTC-PAMP or both bodies.

Features of Digital Gold

- Backed by real assets with high liquidity: The online acquisition of each gram of gold is backed by an equal measure of physical gold, which can be liquidated at any point of time by selling online at the prevailing market rate of gold. Thus, one can obtain instant funds, credited to one’s bank account by selling one’s gold holdings.

- Purity guaranteed: The purity is guaranteed as the gold purchased comprises 24K (99.5 % purity) standard of physical gold. One’s money is channelized entirely towards buying gold only, unlike jewelry where one might end up cumulatively paying for semi-precious stones and other lower value components, embedded within the ornaments.

- Stringent quality checks: The physical gold is completely insured and accepted by the vault after detailed quality checks conducted on multiple variants like weight and purity.

- Small investment size: This democratization of investing in gold allows greater participation by retail investors. One need not have to wait until one has built a sizeable lump sum in order to buy digital gold. Even with a nominal investment amount, one can be assured of obtaining a certain amount of gold.

- Secure storage: The vaults, as custodians, are entirely responsible for secure storage of the gold. The investor need not have to worry about the safety aspect or the risk of loss of valuable gold assets. Further, the facility is extended with negligible or zero charges, unlike bank lockers that charge annual fees, service charges, etc to store physical gold and other expensive possessions.

- Conversion option: One can even exercise the option to obtain physical gold instead of selling digital gold. In such a case the physical gold would be delivered to the registered address of the investor in the form of gold bars or coins.

Conclusion

Whether digital gold will have the golden touch, only time will tell. One thing’s for sure. With its several winning features like easy to register and trade in gold, economical gold pricing being 1.5-2.5% over the landed price as against a 4-5% mark up in case of buying physical gold from a jeweller and fungibility with physical gold, it’s just a matter of time, before digital gold has the blessings of the millennial investors. Why not be ahead of your time and opt for digital gold before it becomes the popular investment choice for gold amongst millennials?

Make small investments for bigger returns.

Make small investments for bigger returns.