The US stock market is home to some of the largest and robust companies with sturdy underlying fundamentals, who are poised to prosper despite the uncertain future.

The market is comprised of a multitude of sectors which includes technology, energy and many others. One can truly create a diversified portfolio by investing in the US stock market. In the long run, as an investor investing in US stocks helps with diversification in terms of geography as well as the ability to invest in large companies, the scale and size of which is unavailable locally.

Taking your current portfolio into account, an addition of US equities will add stability without sacrificing returns. Investing in global equities as an Indian gives you the opportunity to participate in the growth of global economies. Here are a few reasons why one should invest in US stocks:

1. Global Exposure

The S&P 500 is an American index based on 500 of the largest listed companies and their market capitalization. In 2017, the S&P 500 foreign sales report showed that over 43.7% of their revenue was made from outside the United States. Out of this, Asia accounted for around 8.26% of all the sales made in S&P 500.

A majority of listed companies in the US are foreign companies who have penetrated the US market to take advantage of the large number of investors and to be where the money is. While being invested in US stocks, actual exposure to the US economy is relatively low. Purchasing stocks from the US market will have you not only be invested in the American market but also in international markets giving you access to the whole world.

2. Largest and Most Liquid Market

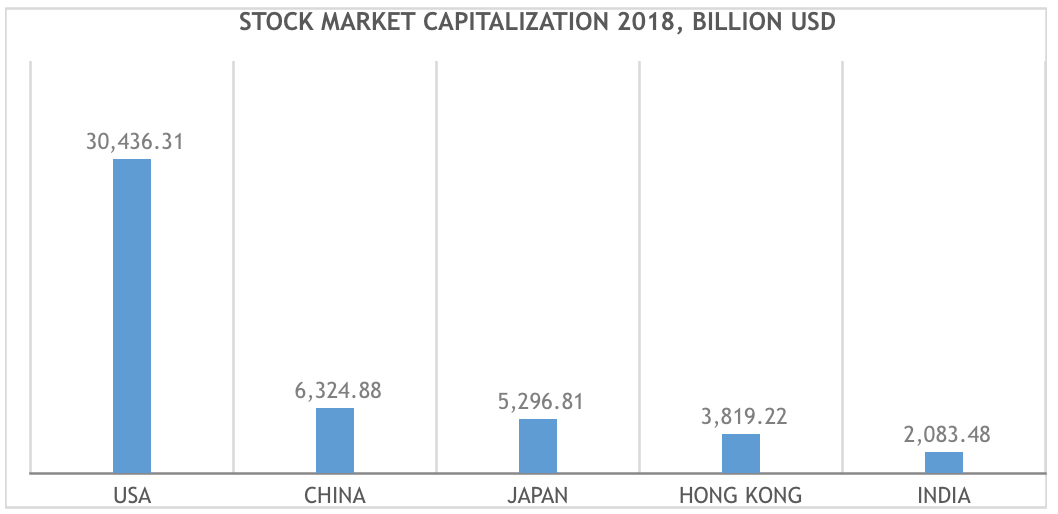

Market Capitalization refers to the total value of outstanding shares of a listed company which can be traded. The US is the top most country in the world in terms of market capitalization as can be clearly seen in the below given graph. The market capitalization of the US is nearly five times that of China and fifteen times that of India.

Source – The Global Economy

The US market is also one of the most liquid markets in the world with nearly US$33 billion worth of trades going through the US stock exchange in 2018, more than double that of China’s.

Country Name | 2018 Share Trade Volume (US$ Billion) |

United States of America | 33,027 |

China | 13,070 |

Japan | 6,304 |

South Korea | 2,455 |

Hong Kong | 2,266 |

Source: World Bank

3. Currency Exposure

When one invests in global stocks they are exposed heavily to currency exchange rate fluctuations. One must take precautions while investing in equities with volatile and unstable currency.

In the last decade, the Indian Rupee has depreciated approximately 37% against the US dollar. By taking this into consideration, we can see how an investor who has invested in US stocks would have seen their returns boosted by the depreciating rupee over the years.

India’s economy in comparison to the US is more likely to remain a higher inflated economy, keeping the trend unchanged. Diversification and long term positioning will keep investors in the green and help them benefit from rupee depreciation.

4. FAANG

Simply put, the acronym FAANG represents five stocks which are Facebook, Amazon, Apple, Netflix and Google. Traded on the NASDAQ, investors turn to technology companies when they are looking to invest in growth stocks and a large amount of media attention and investors’ portfolios are concentrated around FAANG.

These companies have changed the way we live and have reshaped the world whether it comes to how we purchase goods and services, how we watch movies and play video games and even communicate with our family and friends. FAANG shareholders have no doubt been well rewarded.

The members of FAANG are so massive and profitable that they generate more than a significant amount of the Gross Domestic Product (GDP) in the US. They currently have a market capitalization of around US$ 3.1 trillion and they make up over 10% of the total value of the S&P 500.

5. Performance

S&P BSE 500

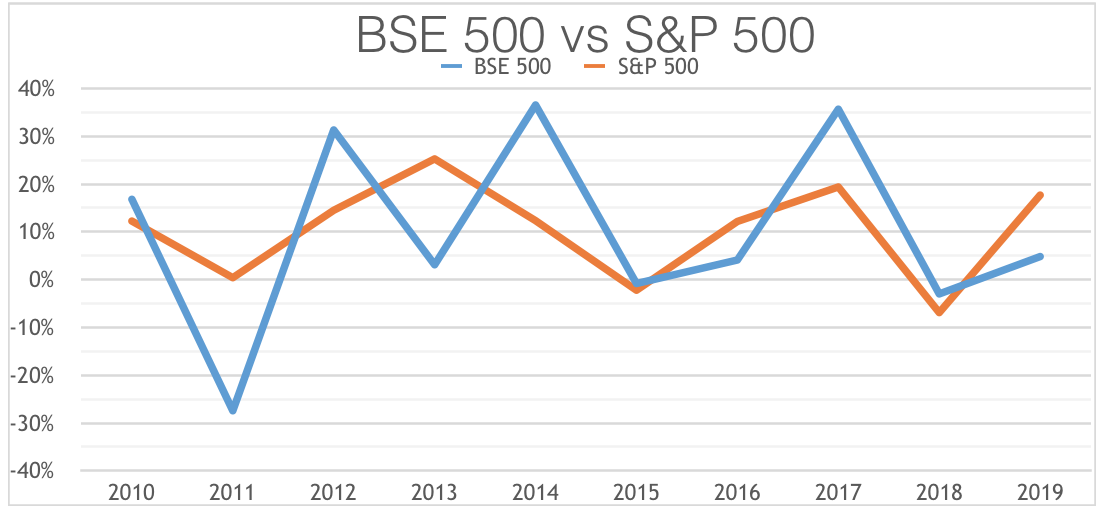

The S&P BSE 500 is a free float weighted market index that represents more than 93% of the market capitalization of the Indian stock exchange. The index also represents the 20 major industries of the Indian economy. It is a broad representation of the Indian market scenario.

S&P 500

This American stock market index represents the market capitalization of the top 500 companies listed on the NASDAQ and the NYSE. This measure is most popularly used by finance professionals and media. It effectively represents the US economy and their many industries. The Market capitalization of S&P 500 as of May 2019 is US$ 2293 Trillion.

YEAR ON YEAR GROWTH

Since 1990, the US markets have greatly outperformed the Indian markets. The Compounded Annual Growth Rate (CAGR) of the BSE 500 is 7.86% and for the S&P 500 is 10.06%.

There are a multitude of opportunities in the US market and analysis shows that the time has come to consider this market to diversify your assets outside the country as well. The US is an economic superpower and its innovative nature offers a competitive edge to its investors. Several factors make US a highly lucrative market.

Make small investments for bigger returns.

Make small investments for bigger returns.